CONTACT US

-

2225 East Bayshore Road, Suite 200

Palo Alto, CA 94303

(877) 738-1838

877-PET1VET

By Eugenia Gutman

Updated April 27, 2020

Throughout All About Pet Insurance website, we keep mentioning that decision about pet insurance is quite complex and depends on your values and beliefs, as well as your financial situation. The following example of actual choices and cost of pet insurance plans for an 8 years old Golden Retriever should demonstrate what it means.

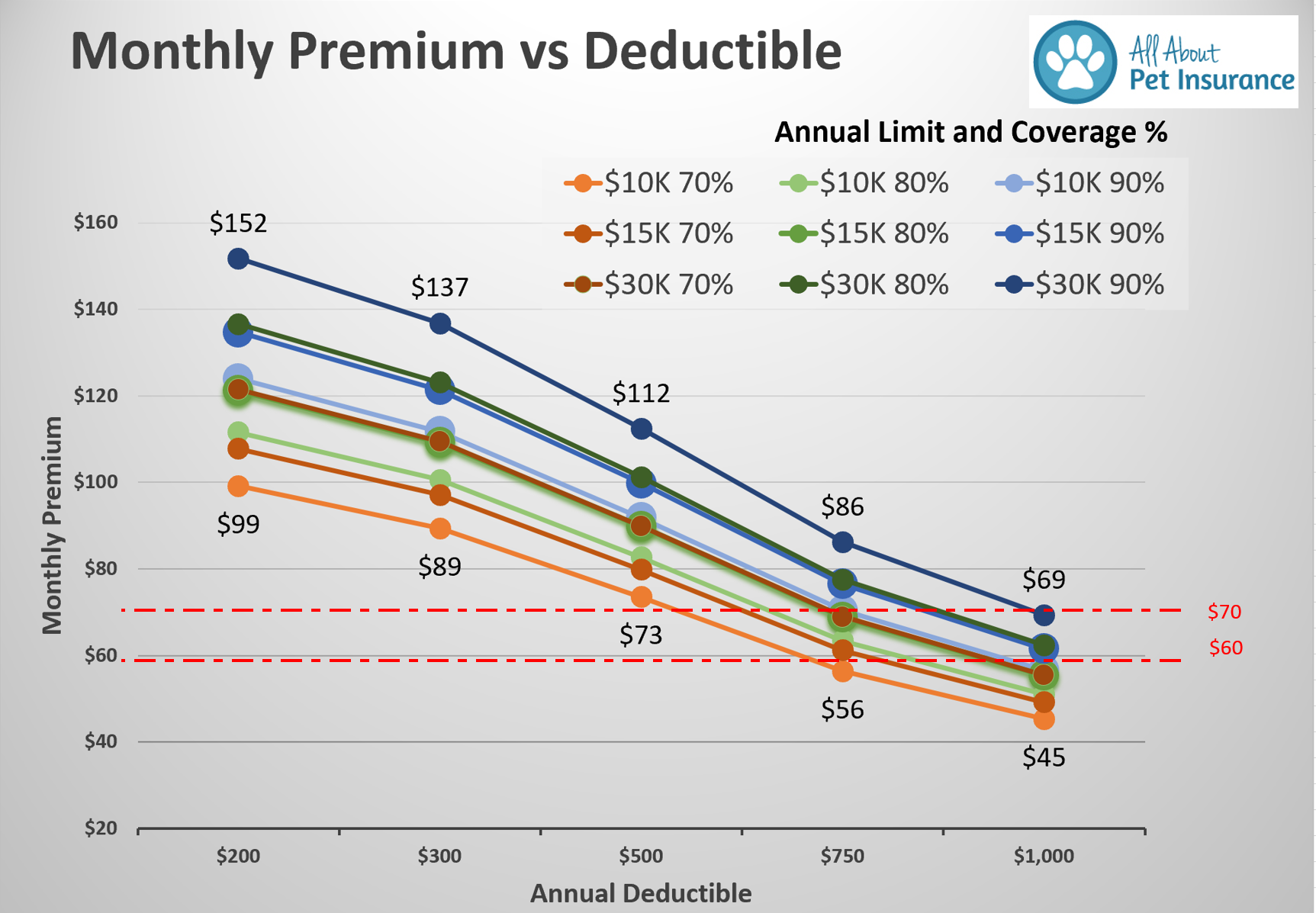

The below graph shows monthly premiums for nine different combinations of annual limit and coverage rate – orange, green, and blue lines, and how premiums for each combination decrease with higher deductibles – points on each line correspond to the deductible amount on the X axis. For example, the cost of a plan with $10K annual limit and 70% coverage (light orange line on the graph) is $99 per month for a $200 deductible and goes down to $45 for a $1000 deductible.

Graph: Pet Insurance prices for an 8 years old Golden Retriever in San Francisco Bay Area as of March 12, 2020. Comprehensive (accident & illness) coverage from one of the top-rated Pet Insurance companies, includes diagnostic tests without per test limits, and payouts based on actual vet bill (not “expected and reasonable cost of treatment/procedure in your area”.)

Cost of the pet insurance plan with $30K annual limit and 90% coverage (dark blue line on top) starts at $152 for a $200 deductible and drops to $69 for a $1000 deductible. Please don’t be discouraged by how much insurance in this particular example cost – this is one of the most expensive areas in the country and an older pure breed Golden Retriever dog. The cost for a breed with fewer predispositions to illnesses and in a less expensive area will be lower! Average price of pet insurance for dogs is $42 per month according to ValuePinguin. Let’s focus on how many options there are (from $45 to $152 per month) and how to choose one that will suit your needs.

To better understand the difference, it is helpful to look at the plans that cost about the same and evaluate payouts in different scenarios. There 6 plans that fall into $60 - $70 monthly premium category:

|

Plan

(annual limit, coverage rate, deductible) |

Monthly Premium (8 years old Golden Retriever in SF area) |

|

|

$73 |

|

|

$65 |

|

|

$70 |

|

|

$69 |

|

|

$69 |

|

|

$69 |

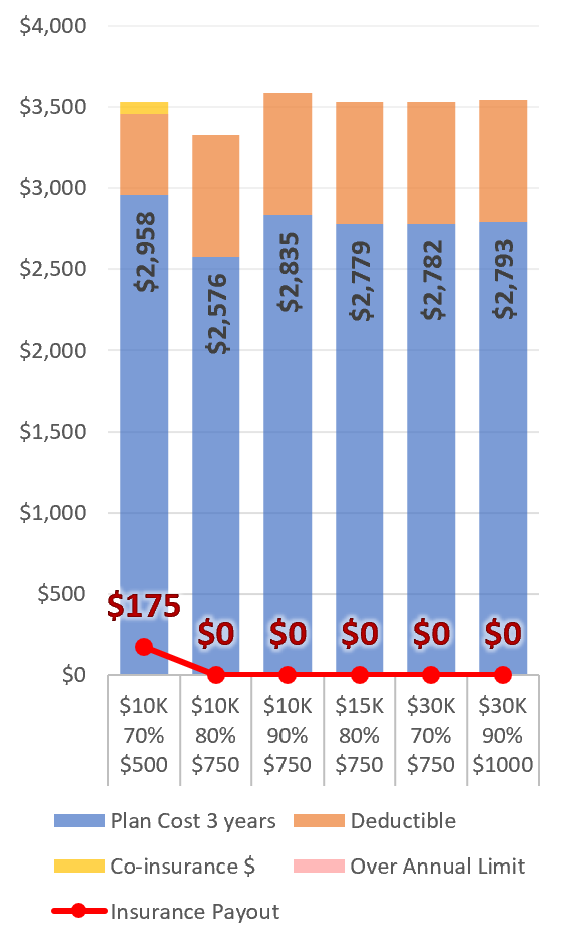

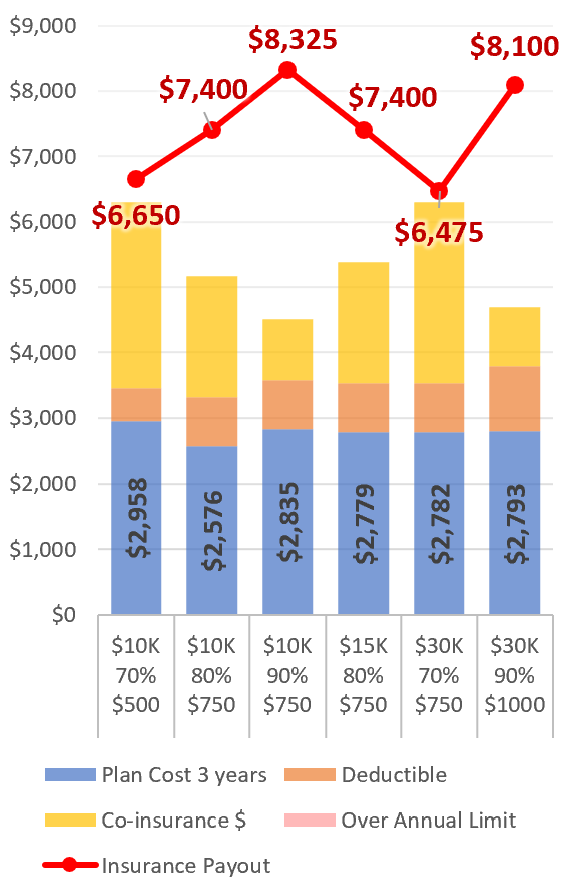

Let’s look at pet insurance premiums and out of pocket costs versus payouts/benefits for each of the above 6 plans in a few hypothetical scenarios. Again, for the purpose of understanding, let’s assume that in all our scenarios our Golden Retriever was healthy for almost three years, but then at the end of the third year some problems happened.

Say your Golden Retriever had three ear infections during the third year. Not a big deal, ear infection is the most common illness in Golden Retrievers and quite annoying, but not exactly deadly if treated in time. With the average vet bill of about $250 to flash the ear and medication for follow-up treatment it could easily add up to $750 per year.

Say your Golden Retriever had three ear infections during the third year. Not a big deal, ear infection is the most common illness in Golden Retrievers and quite annoying, but not exactly deadly if treated in time. With the average vet bill of about $250 to flash the ear and medication for follow-up treatment it could easily add up to $750 per year.

Red line on the cost-benefits chart on the left shows pet insurance payout. Plans with $750 deductible would not pay anything, but the plan with $500 deductible would. Here is how payment is calculated for $10K 70% $500 plan:

Payout calculation

Cost of treatment: $750

Minus deductible 1: -$500

Remaining amount: $250

Co-insurance 30% 2: -$75 (30% * $250)

Insurance Payment: $175

Cost:

3 years of premiums payments 3 (dark blue column on the chart): $2,958

Deductible (orange on the chart): $500

Co-insurance (yellow): $75

Total Cost: $3,533

Total Benefit: $175

The point of this example is that you won’t save money on small somewhat expected vet bills for your Golden Retriever with pet insurance. Even if you chose pet insurance plan with lower deductible, for example $200, the difference you would pay in premiums would always be higher than the difference in deductible. Back to the chart – the dark blue column will raise from $3,533 to over $3,833; more then by $300 that is the difference between $200 and $500 deductibles. Based on the first chart and annual expected premiums increases as your Golden Retriever gets older, you would pay about $4,000 in premiums over three years for a $10K 70% $200 plan.

Who should buy pet insurance plan with lower deductible? Someone who is very bad at saving money. In a sense pet insurance would be a budgeting tool, however a very expensive one. We would say it is similar to a situation when you just can’t make yourself go to the gym. Hiring a personal trainer who would remind you about gym appointments will help you get fit, but it is much more expensive than simply buying gym membership.

1 Most pet insurance companies follow deductible then co-insurance payout model, i.e. deductible is applied first, and then co-insurance is applied to the remaining amount. Some, however, use co-insurance then deductible model. The later model will result in higher out of pocket cost. The maximum difference between the two payout models would be no higher than deductible multiplied by co-insurance. For $10K 70% $500 pet insurance plan, the highest difference you could expect is $150 ($500 * 30%).

2 Co-insurance is the opposite of coverage rate. 30% co-insurance is paid out of pocket when coverage rate is 70%. 3 Premiums increase with dog’s age. The cost of $10K 70% $500 plan for our eight years old Golden Retriever is $73 but will increase to roughly $82 when she turns 9, and to $91 when she turns 10. Pet insurance companies also reserve the right to increase premiums should the cost of veterinary care rise.

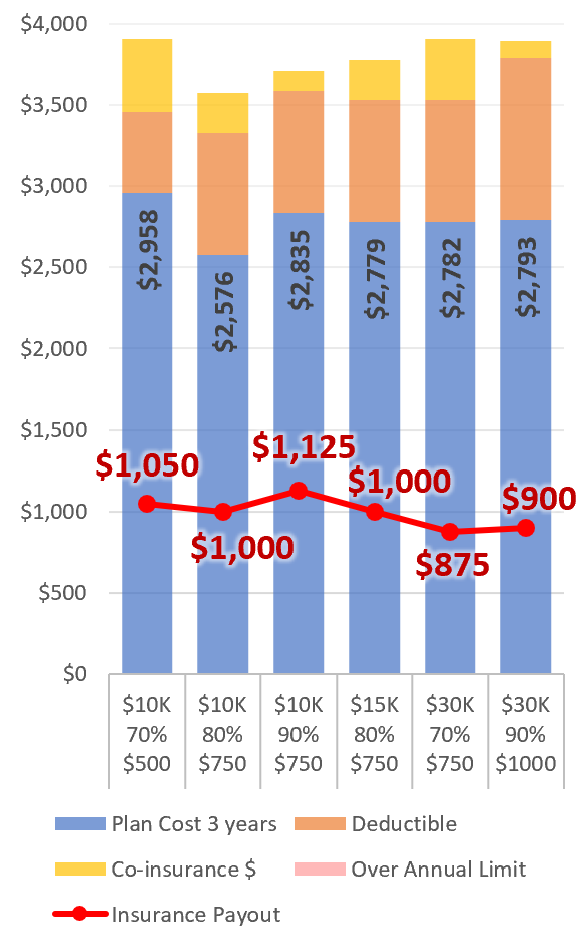

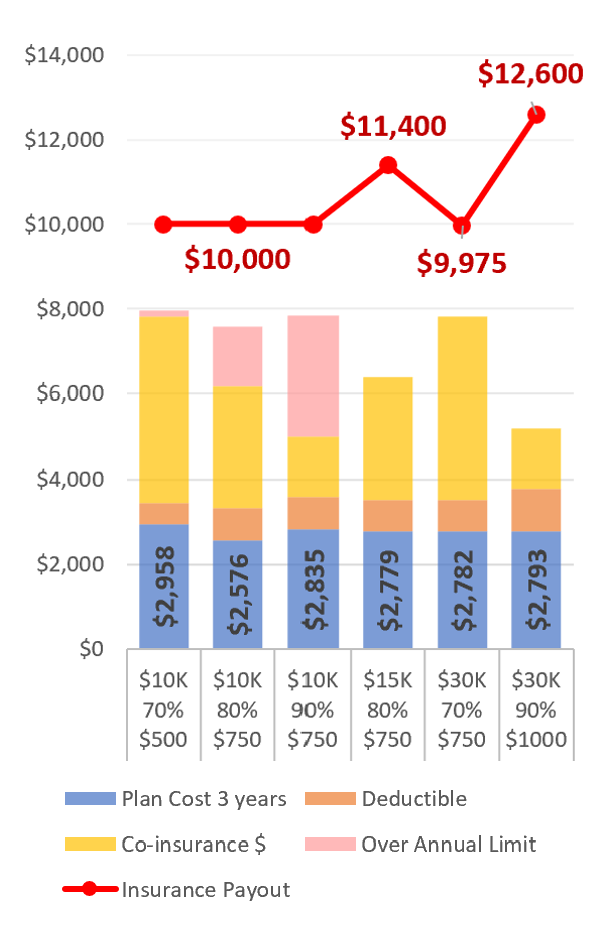

All it takes is your Golden Retriever ingesting one small toy or sock to cause a blockage in her gastrointestinal tract. The cost to treat intestinal obstruction ranges anywhere from $800 to $7,000 according to PetCoach. Let’s say you got “lucky” and cost for your Golden is only $2000.

All it takes is your Golden Retriever ingesting one small toy or sock to cause a blockage in her gastrointestinal tract. The cost to treat intestinal obstruction ranges anywhere from $800 to $7,000 according to PetCoach. Let’s say you got “lucky” and cost for your Golden is only $2000.

$10K 90% $750 plan will get you the highest claim payout of $1,125. But you get best cost/benefits ratio from $10K 80% $750 plan because it cost you less over the three years.

Payout calculation

for $10K 80% $750 plan:

Cost of treatment: $2000

Minus deductible: -$750

Remaining amount: $1250

Co-insurance 20%: -$250 (20% * $1250)

Insurance Payment: $1000

Cost:

3 years of premiums payments: $2,576

Deductible: $750

Co-insurance: $250

Total Cost: $3,576

Total Benefit: $1000

In this scenario you are likely happy that you have pet insurance, thought you would have survived without it. You would save on premiums and get the best cost/benefits ratio If you purchased pet insurance plan with higher co-insurance ($10K 80% $750 plan). The higher co-insurance plan, however, will not have the best cost/benefits ratio if cost of treatment is higher.

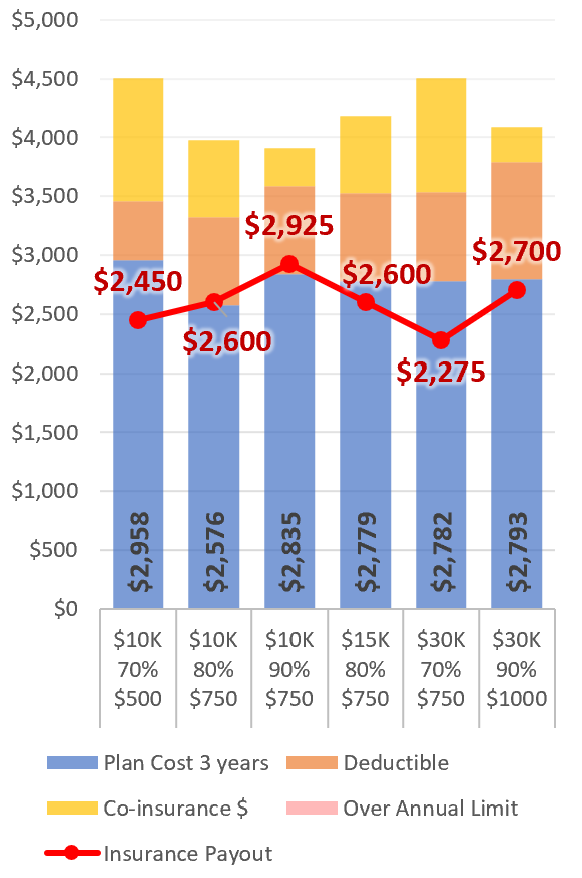

What if you didn’t get “lucky” as in scenario 2 and your vet bill for swallowed sock is closer to the higher end - $4,000…

What if you didn’t get “lucky” as in scenario 2 and your vet bill for swallowed sock is closer to the higher end - $4,000…

$10K 90% $750 plan will get you the highest claim payout of $2,925 and the best cost/benefits ratio because of lower co-insurance

Payout calculation

for $10K 90% $750 plan:

Cost of treatment: $4,000

Minus deductible: -$750

Remaining amount: $3,250

Co-insurance 10%: -$325 (10% * $3,250)

Insurance Payment: $2,925

Cost:

3 years of premiums payments: $2,835

Deductible: $750

Co-insurance: $325

Total Cost: $3,576

Total Benefit: $2,925

In this scenario you break even on your pet insurance, i.e. your claim payout is about the same as amount you paid in premiums over the three years. How likely is it to happen? The expected outcome of any insurance will always be negative, meaning that you hope that you pay more in premiums then you receive in claims. You only get “lucky” and get profit from your insurance investment if your Golden Retriever gets very unlucky. Like reverse lottery - you are not very likely to win, but someone will. And yes, sometimes it is you…

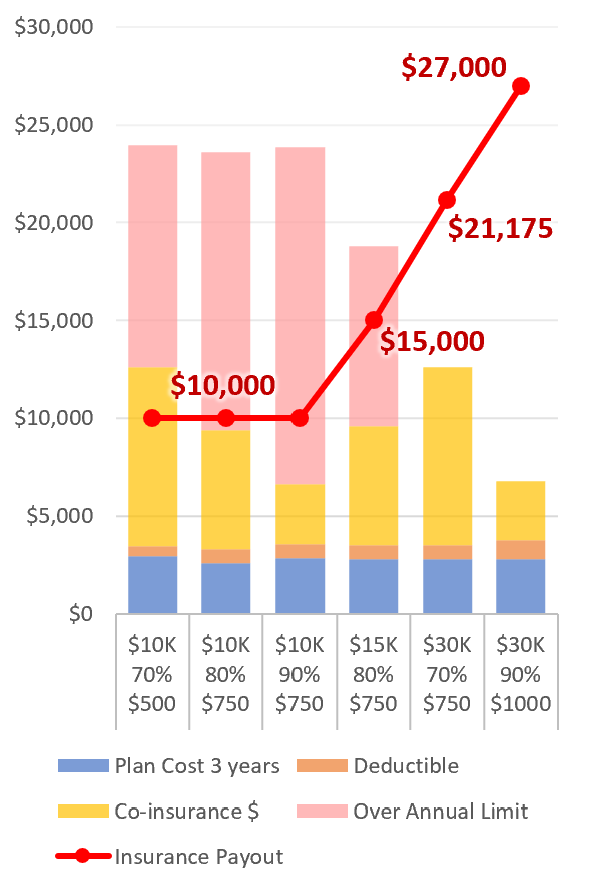

The rate of cancer is about 60% in Golden Retrievers according to a report by CBS news, one of the highest in the dog world. Not all cancers are this expensive to treat, and some are so deadly that effectiveness of treatment just doesn’t worth the suffering it causes. But let’s say, once again you got “lucky” and your Golden has a good chance of surviving and striving with the treatment.

The rate of cancer is about 60% in Golden Retrievers according to a report by CBS news, one of the highest in the dog world. Not all cancers are this expensive to treat, and some are so deadly that effectiveness of treatment just doesn’t worth the suffering it causes. But let’s say, once again you got “lucky” and your Golden has a good chance of surviving and striving with the treatment.

Again, $10K 90% $750 plan will get you the highest claim payout, the highest cost/benefits ratio, and the lowest out of pocket payment at the time of treatment:

Payout calculation

for $10K 90% $750 plan:

Cost of treatment: $10,000

Minus deductible: -$750

Remaining amount: $9,250

Co-insurance 10%: -$925 (10% * $9,250)

Insurance Payment: $8,325

Cost:

3 years of premiums payments: $2,835

Deductible: $750

Co-insurance: $925

Total Cost: $4,510

Total Benefit: $8,325

This is when pet insurance is really worth it!

These are very big vet bills! Can this really happen? Very rarely, but it does. We don’t want to use scare tactics to force you to buy pet insurance, but you should ask yourself whether you’d be able to give up on your dog because of the cost of treatment. One family did spend $31,000 on treatment for their dog according to AARP, and another spent $42,000 to treat a cat in one year according to their comment on Washington Post article.

This is where you want high annual limit or, better yet, an unlimited plan.

$15,000 Vet Bill

|

$31,000 Vet Bill

|

Variety of pet insurance plans offering varying levels of coverage are available in the US. The cost varies greatly as well, from $10 per month for an accident only plan to $150 for comprehensive illness coverage in our example. We invite you to weight pros and cons of a pet insurance and make a decision that's right for you, your family and your puppy. Take a look at out our top 10 pet insurance companies rating to learn more about available pet insurance plans.

>> Top 10 Pet Insurance Companies

>> Best Pet Insurance for Your Dog

Spot Pet InsuranceThe Dog Whisperer Cesar Millan has partnered with Spot Pet Insurance as he believes "pet health is number one"! |

EmbraceEmbrace Pet Insurance offers broad variety of plans and diminishing deductible feature |

Petplan

One of the oldest and most respected pet insurance companies, Petplan offers comprehensive health coverage in one simple plan. |

(877) 738-1838

877-PET1VET